Saudi Arabia diversifies with new China naval drills, but military remains Western-centric

Expanding Saudi-Chinese defense cooperation mirrors the broader deepening of Saudi-Chinese diplomatic and economic relations.

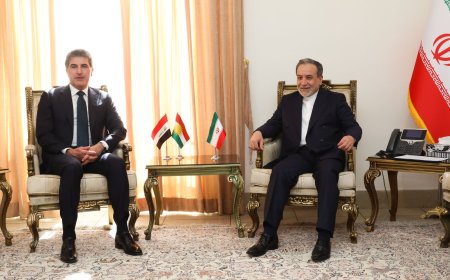

While US President Donald Trump led the signing of Gaza ceasefire agreements on Monday in Sharm el-Sheikh, Saudi Arabia and China kicked off Blue Sword 2025, the third iteration of the joint naval exercise, signaling a growing defense partnership in a turbulent region.

The drill began Oct. 13 at the King Abdulaziz Naval Base in Jubail, headquarters of the Royal Saudi Naval Forces’ Eastern Fleet. The exercise was designed to enhance operational readiness, improve tactical interoperability and facilitate knowledge sharing between the two navies over a three-week period.

While few details have been released about the operational scenarios or the number and types of vessels involved, staging the third iteration of the drill in the kingdom’s territorial waters underscores the exercise’s institutionalization. Since its launch in 2019 — the 2021 edition was canceled due to the COVID-19 pandemic — Blue Sword has evolved into a biennial platform for tactical exchanges and joint training, alternating between Saudi and Chinese waters.

This development underscores how expanding Saudi-Chinese defense cooperation mirrors the broader deepening of Saudi-Chinese diplomatic and economic relations.

Evolving naval cooperation

Blue Sword 2025 extends a pattern of increased defense collaboration between China and Saudi Arabia. The two nations have conducted a growing number of military exchanges in recent years — for example, personnel exchanges, joint coordination and technology sharing — reflecting their closer political and economic ties.

Riyadh and Beijing launched the first Blue Sword in November 2019, with Saudi Arabia hosting the naval drills, their first, which focused on maritime security threats, such as piracy and terrorism. That initial iteration served as a confidence-building measure, allowing the Royal Saudi Navy and the Chinese People’s Liberation Army Navy to test coordination in patrols and joint response drills.

In October 2023, the exercise moved to Zhanjiang and introduced expanded operational elements, such as helicopter fast-roping, underwater reconnaissance, drone integration and a simulated hijacked vessel scenario. This second drill broadened the scope of training to include more complex special operations.

Chinese Ministry of National Defense spokesperson Senior Colonel Jiang Bin said this year's exercise aims to “enhance the exchange of tactics and technologies” and “deepen friendly relations and practical cooperation between our two militaries.” Holding the exercise at the Eastern Fleet’s King Abdulaziz Naval Base underscores Riyadh’s willingness to host large-scale drills with a major non-Western power, signaling a more open posture toward diversifying its military partnerships.

Blue Sword 2025 entails a sophisticated tactical agenda with expectations of a focus on advanced joint maneuvers, expanded logistical cooperation, and coordination across multiple maritime domains. For the Royal Saudi Navy, the exercise provides an opportunity to test interoperability with a non-Western counterpart and to explore alternative tactical approaches. For the Chinese navy, it offers operational experience in Gulf waters and closer observation of regional maritime dynamics.

Modest, but meaningful, cooperation

Military cooperation between Saudi Arabia and China dates back to the 1980s, when Riyadh secretly acquired from Beijing DF-3 intermediate-range ballistic missiles, the kingdom's first major strategic missile acquisition. In subsequent decades, Chinese weapons systems have filled specific operational niches within the Saudi arsenals, including the more modern DF-21 medium-range ballistic missiles, reportedly delivered in the late 2000s with US acquiescence. The Saudis also acquired CH-4 and CH-5 reconnaissance and attack UAVs, unmanned aerial vehicles; CAIG Wing Loong drones; PLZ-45 (Type-88) 155 mm self-propelled howitzers; and since 2017 locally licensed production of CASC Rainbow drones. Most of these weapons were extensively used in fighting Houthi rebels when a Saudi-led coalition intervened in the Yemeni civil war in March 2015.

Despite this long-standing relationship, the overall scale of Chinese defense exports to Saudi Arabia remains limited. According to data for 2020–24 compiled by SIPRI, the Stockholm International Peace Research Institute, China accounted for only 1–2% of Saudi arms imports, compared with the United States’ 78% share over the same period. This structural imbalance reflects Riyadh’s enduring dependence on US and European defense systems, training, logistics and sustainment networks.

As Naser Al-Tamimi, senior associate research fellow at the Italian Institute for International Political Studies, wrote in a September 2024 analysis for the Friedrich Ebert Foundation, “Despite growing economic and diplomatic relations, Saudi Arabia’s defense collaboration with China is relatively modest, mainly involving joint exercises and drills, counter-terrorism efforts, sales of specific weapon systems, and cooperative production of armed drones.”

Exercises like Blue Sword thus stand among the most visible signs of this joint engagement, reflecting political signaling rather than a major strategic shift, he argues.

Barriers to integration

Technical and structural barriers remain a significant an issue the Saudi-Sino defense relationship. It is often difficult to integrate Chinese weapons and Saudi Arabia’s Western-centric military ecosystem. Decades of doctrinal alignment, training pipelines, maintenance structures and supply chains built around US and European suppliers make large-scale substitution both costly and risky for Saudi Arabia. Under these constraints, China’s role in Saudi defense remains complementary rather than central — a calculated hedge, not an alternative alliance.

While Blue Sword 2025 may appear at first glance to be a routine joint exercise, the timing and location of it carries deeper strategic weight. The maneuvers are taking place in Saudi waters at the junction of the Gulf and the Arabian Sea, a maritime corridor vital to Sino–Saudi relations. According to the Saudi Press Agency, nearly a quarter of the kingdom’s crude exports — 24.3% in first five months of 2025 — flows to China on tankers traversing these same waters. In other words, such joint naval drills as those focused on counter-piracy, maritime security and tactical coordination are taking place in the very sea lanes underpinning the two countries’ energy interdependence.

Economic ties deepen

The drills coincide with a deepening of Saudi–Chinese economic ties. Last month, Saudi Industry and Mineral Resources Minister Bandar Alkhorayef led a five-day mission to Beijing and Shanghai aimed at strengthening industrial cooperation in manufacturing, technology transfer and critical minerals. That visit — which took place Sept. 22–26, followed one by Investment Minister Khalid Al-Falih in late August in his capacity as a member of the Saudi-Chinese High-Level Joint Committee — builds on such milestones as the 2023 Saudi-Chinese Investment Forum, which yielded more than 60 memorandums of understanding, and the 2024 China–GCC Forum on Industrial and Investment Cooperation.

This push for industrial cooperation reflects Riyadh’s broader Vision 2030 strategy of attracting $100 billion in mining and industrial investment by the end of the decade. Lithium, copper and nickel — metals essential for batteries and clean energy — stand at the core of the strategy, making China, which dominates global supply chains in these fields, a natural partner.

The Saudi Press Agency reported that bilateral trade topped $107.5 billion in 2024, while Chinese foreign direct investment in the kingdom that same year rose 28.8%, to $8.2 billion, with inflows more than doubling, to $2.3 billion. Chinese investment in the kingdom now spans manufacturing, finance, health care, and construction, including such major projects as the Wangkang Group building a construction materials facility in Yanbu and Pan Asia Industrial assembling a $4 billion petrochemical complex in Jubail. This economic convergence forms the backdrop to Sino-Saudi defense cooperation, which remains limited in scale but increasingly significant in strategic symbolism.

Blue Sword 2025 launched at a politically charged moment. Although its timing, coinciding with Trump’s ceasefire ceremony, was likely coincidental, the optics are hard to ignore: Riyadh hosted large-scale drills with Beijing as Washington touted renewed Arab alignment. The drill reinforces Saudi Arabia’s message of strategic diversification rather than a realignment.

[Source: Al-Monitor]